Structured workflow

Often described as organized and easy to follow for DIY filers.

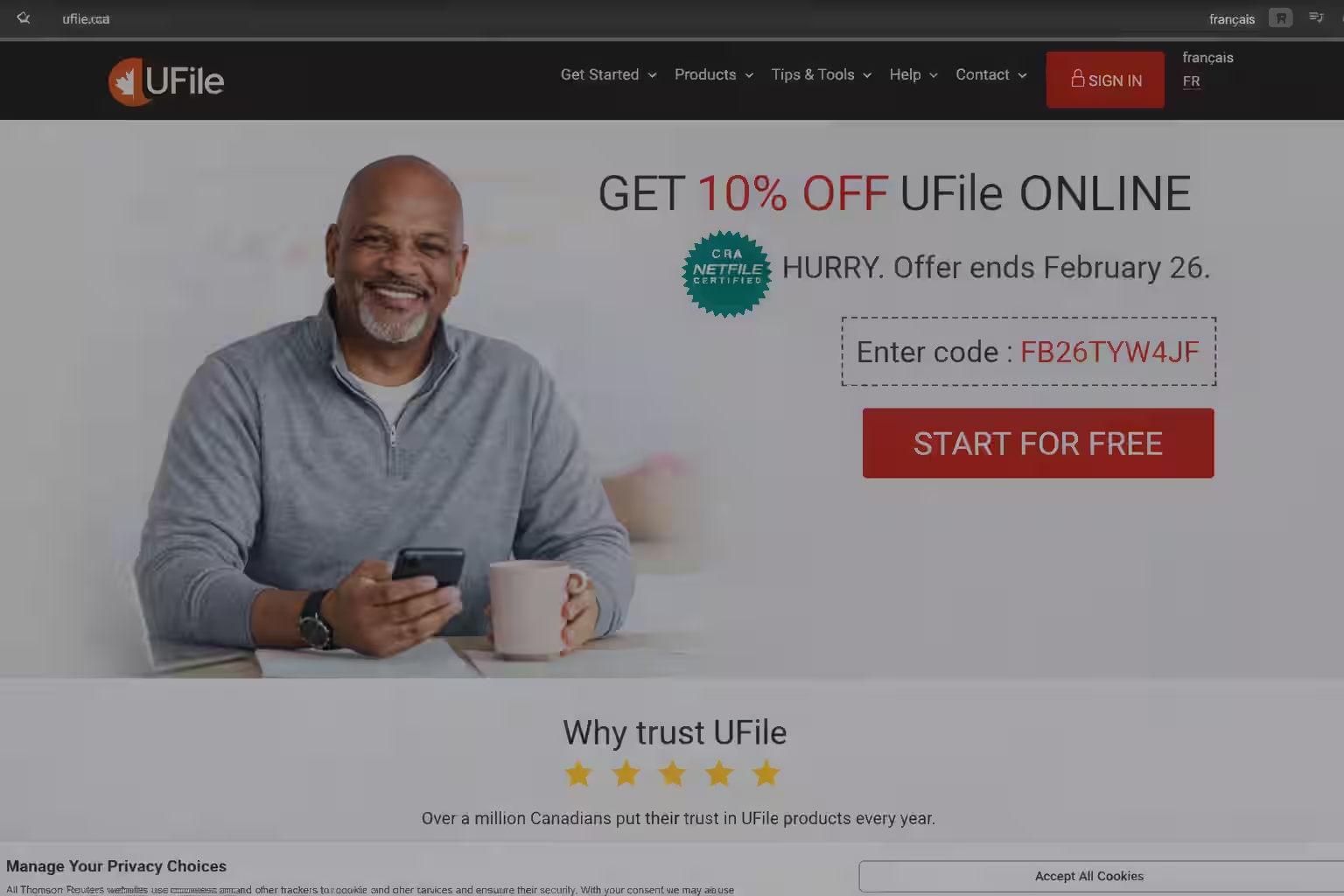

UFile - Canada

A straightforward approach for filers who want structure without too much complexity.

Disclosure: Some links may be affiliate links. We may earn a commission at no extra cost to you.

Best for

DIY filers who want structure

Pricing range

$20.95+ (online)

Platforms

Web (desktop and mobile browser)

CRA NETFILE

Yes (NETFILE certified)

Quebec support

Confirm Quebec support for your plan

Best for

Not ideal for

Pricing and supported situations can change by release.

More guides

Compare accounting tools or catch up on the latest CRA updates before you file.

Accounting guide

Compare top accounting tools, estimated pricing, and best-for picks for 2026.

Read the accounting guide ->

Tax guide

T2125, expenses, GST/HST, QST, and filing workflow basics.

Read the self-employed guide ->

CRA update

Key CRA updates, dates, and filing notes for the 2026 season.

Read the CRA 2026 guide ->

A quick look at UFile Online so you can see the flow before you start filing.

Disclaimer: This video is for general information only and does not replace certified tax software or professional advice.

Prices shown are from the UFile website and can change by plan or tax year.

UFile Online

$20.95

Spouse return

$16.00

Additional family

$10.00

Pricing can change. Always confirm the latest plan details on the official site.

Auto-fill My Return (CRA)

Imports slips directly from CRA when available.

NETFILE certified

Certified for CRA and Revenu Quebec filing.

Forms and slips coverage

Supports over 230 forms and slips.

ReFILE support

Adjust previously filed returns when needed.

Carry-forward handling

Carry-forward amounts handled automatically.

Return storage

Tax return storage for up to 9 years.

Short summaries based on public feedback + our readers. Not official screenshots or quoted testimonials.

What users say: Many users describe a straightforward, structured flow for standard returns.

What to watch for: Some want clearer guidance for complex scenarios or Quebec nuances.

Often described as organized and easy to follow for DIY filers.

Works best when slips and deductions are straightforward.

Some users mention needing extra research for complex scenarios.

Reviews shown here are summarized or user-submitted and may not reflect every experience.

Reviews are moderated before they appear publicly.

A practical pick if you want a structured DIY workflow without extra bells and whistles.

Budget-minded filers

Attractive for DIY filers who want a lower-cost option.

Simple to moderate returns

Works well for common slips and standard deductions.

Families

Supports multiple family members with add-on returns.

DIY filers

Best for people comfortable reviewing their own entries.

Quebec note

Quebec filers should confirm provincial return support and keep RL slips for accurate filing.

Confirm coverage for your exact situation and version before filing.

1) Start a return

Choose your tax year and province.

2) Enter slips

Add your income slips and sources.

3) Add deductions

RRSP, tuition, eligible expenses.

4) Review

Check totals and warnings.

5) Submit

E-file if supported by the version.

6) Keep copies

Save your return and receipts.

A simple three-step visual to show the typical UFile workflow.

Note: These are illustrative visuals, not official screenshots.

Quebec filers should confirm provincial return support and keep RL slips for accurate filing.

It can work well for common situations if your slips and deductions are straightforward.

Confirm provincial return support for the current year and version before filing.

You should keep slips and receipts in case you need to verify deductions later.

Helpful links and external resources for deeper reading.

Canada GST/HST Filing Guide

Step-by-step guide for filing GST/HST returns in Canada.

Read guide ->

Quebec GST/HST + QST Guide

Quebec-focused guide for combined GST/HST and QST filing.

Read guide ->

Best Accounting Software in Canada

Compare small-business accounting tools, pricing ranges, and workflow fit for 2026.

Read guide ->

Open the official UFile page in a new tab.

Note: This opens an external website. We do not control their content or availability.

You are about to open an external UFile resource in a new tab. Your TechNextPicks page will stay open.

Quick overview of important changes (then read the full guide for details).

Educational overview only. Always verify details with CRA / official sources.

Practice simulator

Want a low-stakes walkthrough before you file for real? Use our simulator to practice inputs and see a simplified estimate. No TurboTax or CRA branding, and no official filing is performed.

Practice only • Not affiliated with TurboTax or CRA

If this option fits your needs, continue to the official software page.

Disclosure: Some links may be affiliate links. We may earn a commission at no extra cost to you.

Sources

Suggested prompts

Guest verification

Captcha is enabled but Turnstile site key is missing.

Sources

Suggested prompts

Guest verification

Captcha is enabled but Turnstile site key is missing.