Quebec GST/HST + QST Guide

How to File a GST/HST + QST Return in Quebec (Combined Guide for 2026)

Quebec filers can submit GST/HST and QST together through Revenu Quebec. This guide breaks down the steps, line mapping, and what to expect on the combined return.

Who it is for

Quebec GST/HST + QST registrants filing a combined return

What you need

GST/HST + QST numbers, sales totals, ITCs and ITRs

Time estimate

25-45 minutes for a basic return

Educational + estimate only

This page summarizes the filing flow. Always verify your situation on Revenu Quebec or CRA official pages.

Watch: Quebec GST/HST + QST filing overview

This short walkthrough explains the combined Quebec filing flow. Watch it first, then follow the steps and screenshots below for line mapping.

Disclaimer: This video is for general information only and does not replace official Revenu Quebec or CRA guidance.

Choose your filing path

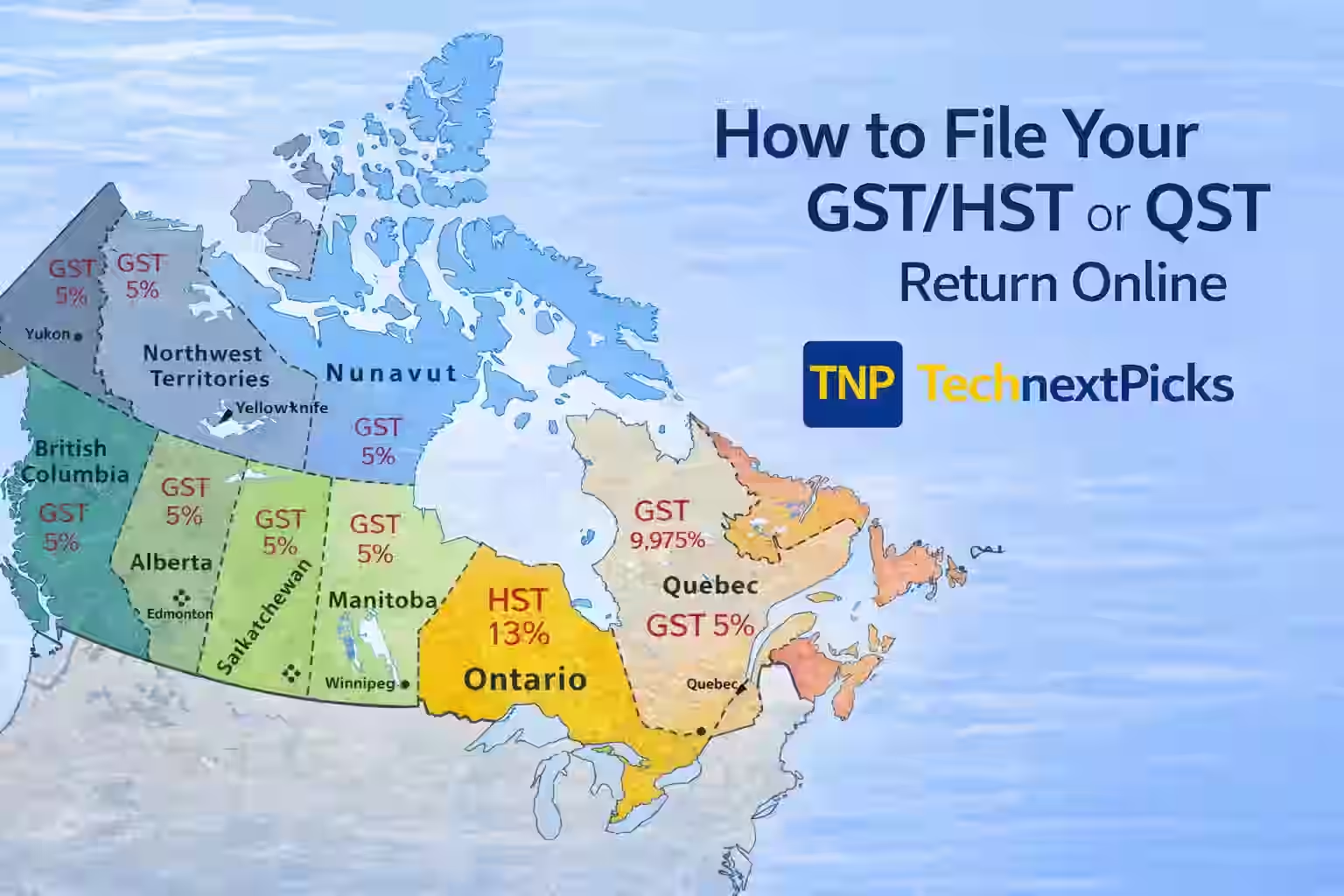

Quebec is different: Revenu Quebec lets you file GST/HST and QST together in one combined return. Other provinces file GST/HST with the CRA and do not file QST.

Before you start (checklist)

- GST/HST number (RT) and QST number

- Reporting period dates for the combined return

- Total sales, GST/HST collected, and QST collected

- ITCs for GST and ITRs for QST with receipts

- Revenu Quebec login access

Use our calculator

Parse your statement and map totals to the return boxes before you file.

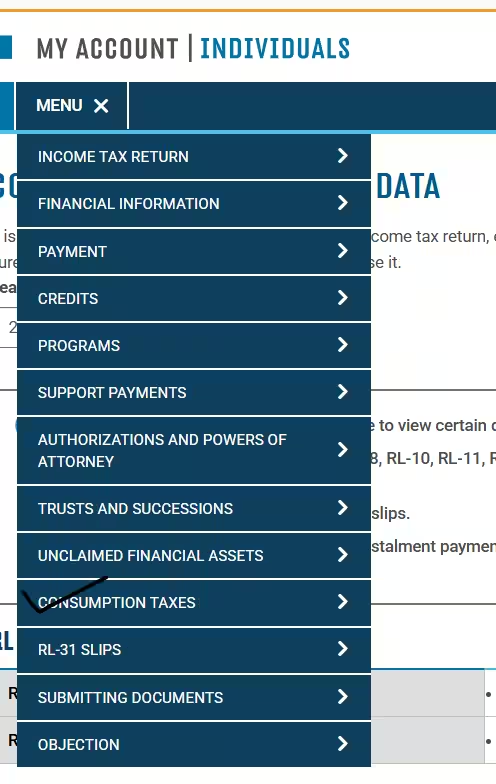

Open GST/QST calculatorStep 1: Login and open Consumption taxes

Sign in to your Revenu Quebec account and open the Consumption taxes area for GST/HST and QST.

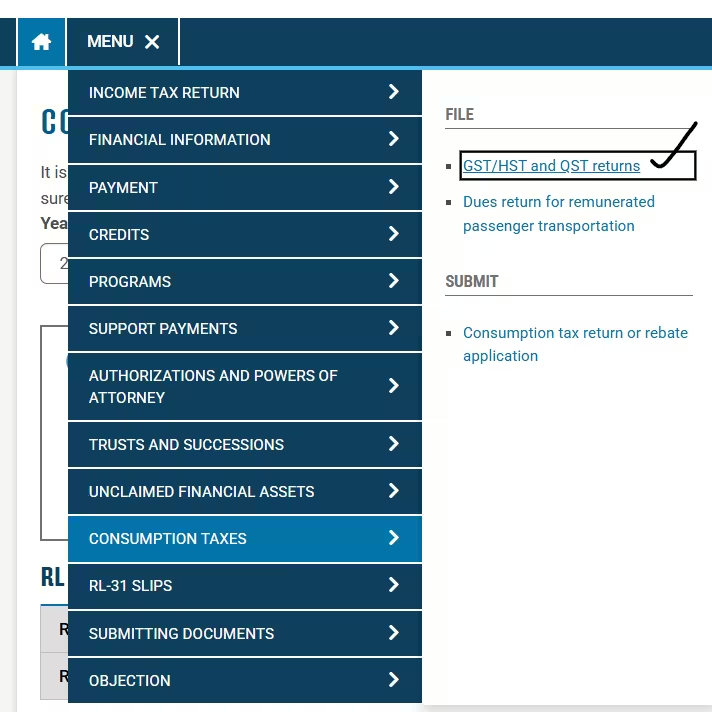

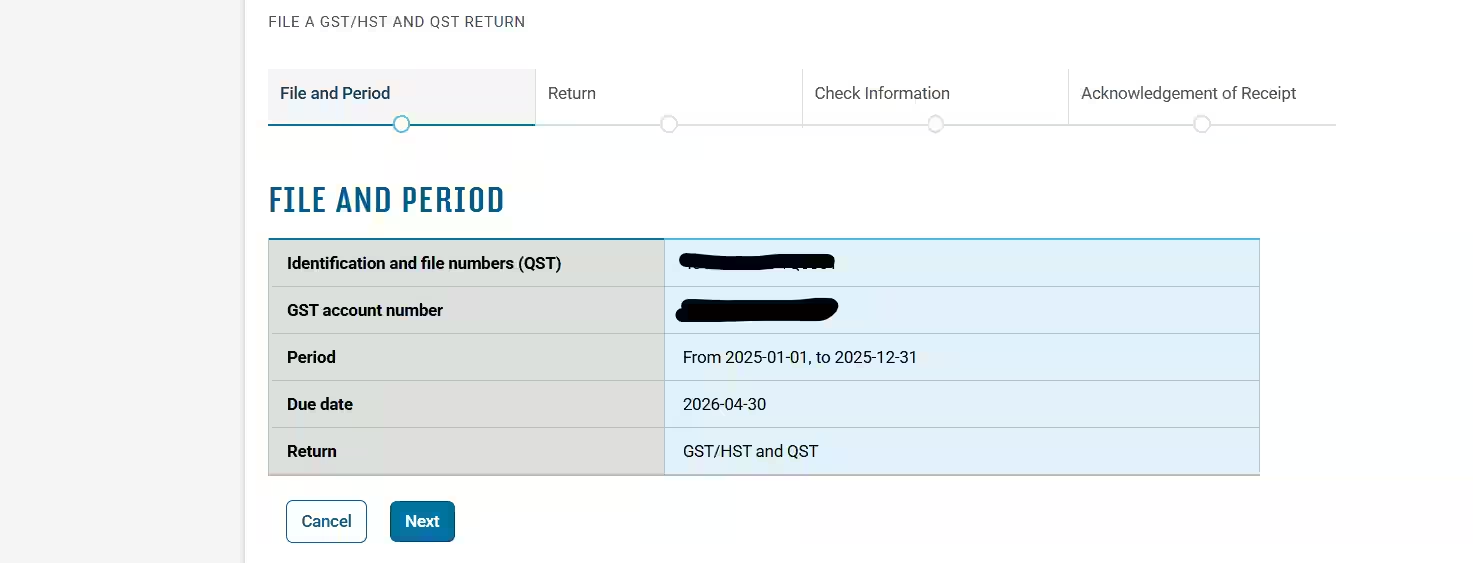

Step 2-3: Open returns and select the period

Open the GST/HST and QST returns area, then choose the correct reporting period before entering totals.

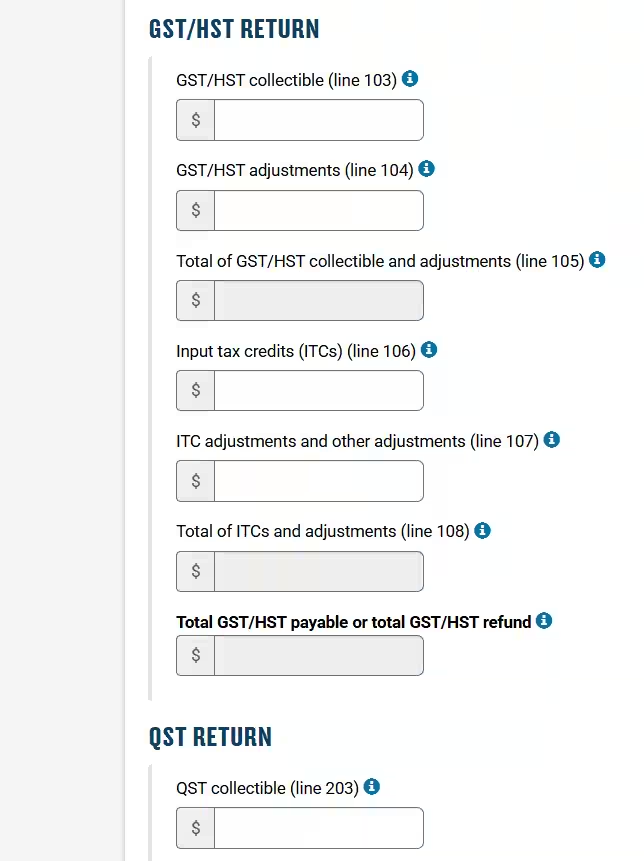

Step 4: GST/HST return lines

Map your GST/HST collected and ITCs. Use the line numbers shown on the combined return.

- Line 103 = GST/HST collectible (GST collected)

- Line 106 = ITCs (GST ITCs)

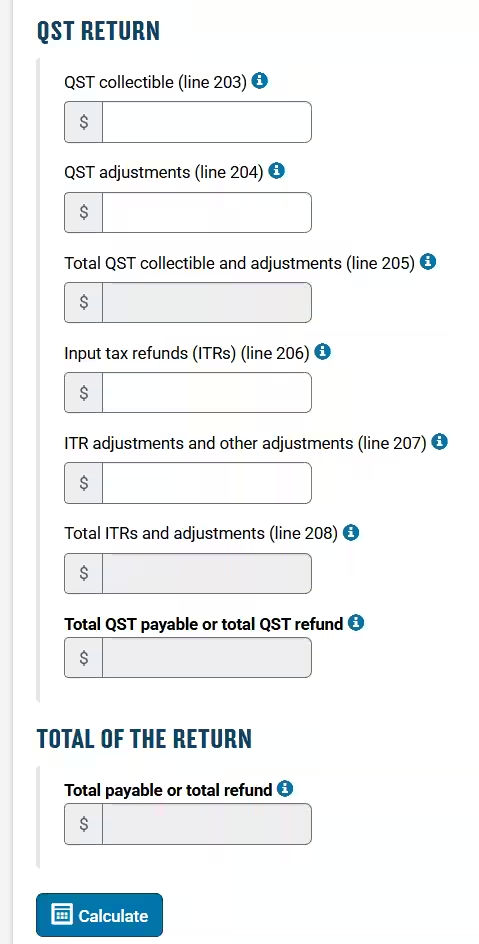

Step 5: QST return lines

Map your QST collected and ITRs to the QST section of the combined return.

- Line 203 = QST collectible (QST collected)

- Line 206 = ITRs (QST ITRs)

Step 6: Review totals and submit

Review the total payable or refund, submit the return, and save the confirmation receipt.

Use the final summary screen to confirm totals, then submit and save the confirmation receipt.

Use our calculator before mapping lines

The calculator formats your totals to match the return boxes for GST/HST and QST.

Open GST/QST calculatorReturn mapping (Quebec combined return)

| Calculator box | Revenu Quebec line |

|---|---|

| GST collected | Line 103 |

| GST ITCs | Line 106 |

| QST collected | Line 203 |

| QST ITRs | Line 206 |

| Total to remit | Total payable/refund |

CRA overview (GST/HST only)

Outside Quebec, GST/HST is filed with the CRA. QST is not part of CRA filing, so you only report GST/HST.

Filing options

CRA My Business Account

Full account access, status tracking, and return filing.

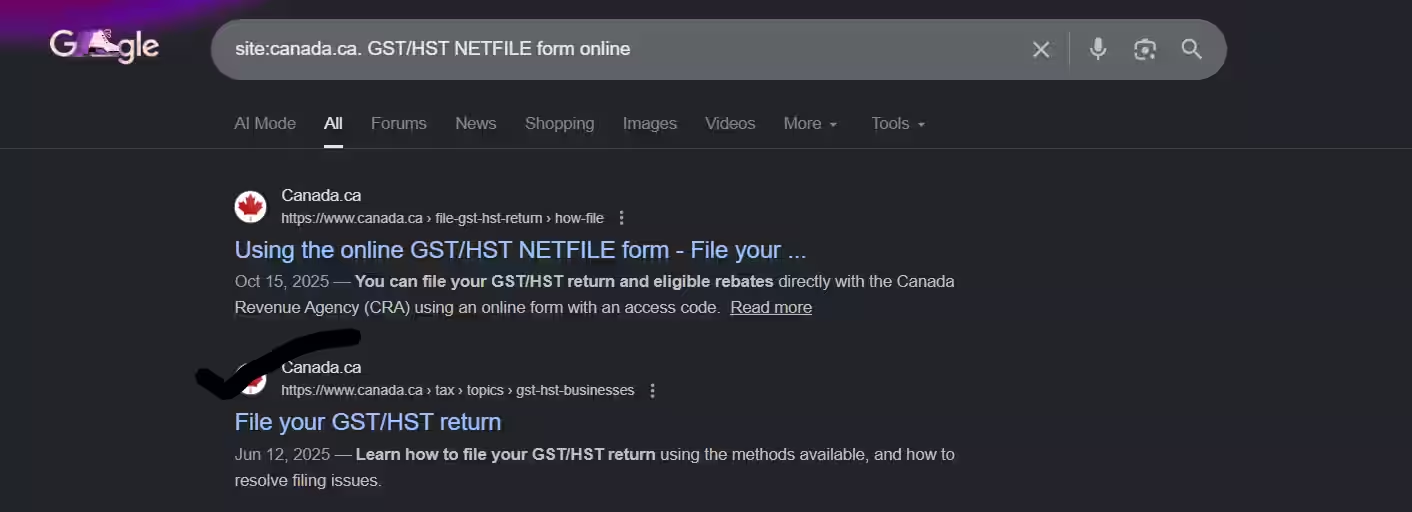

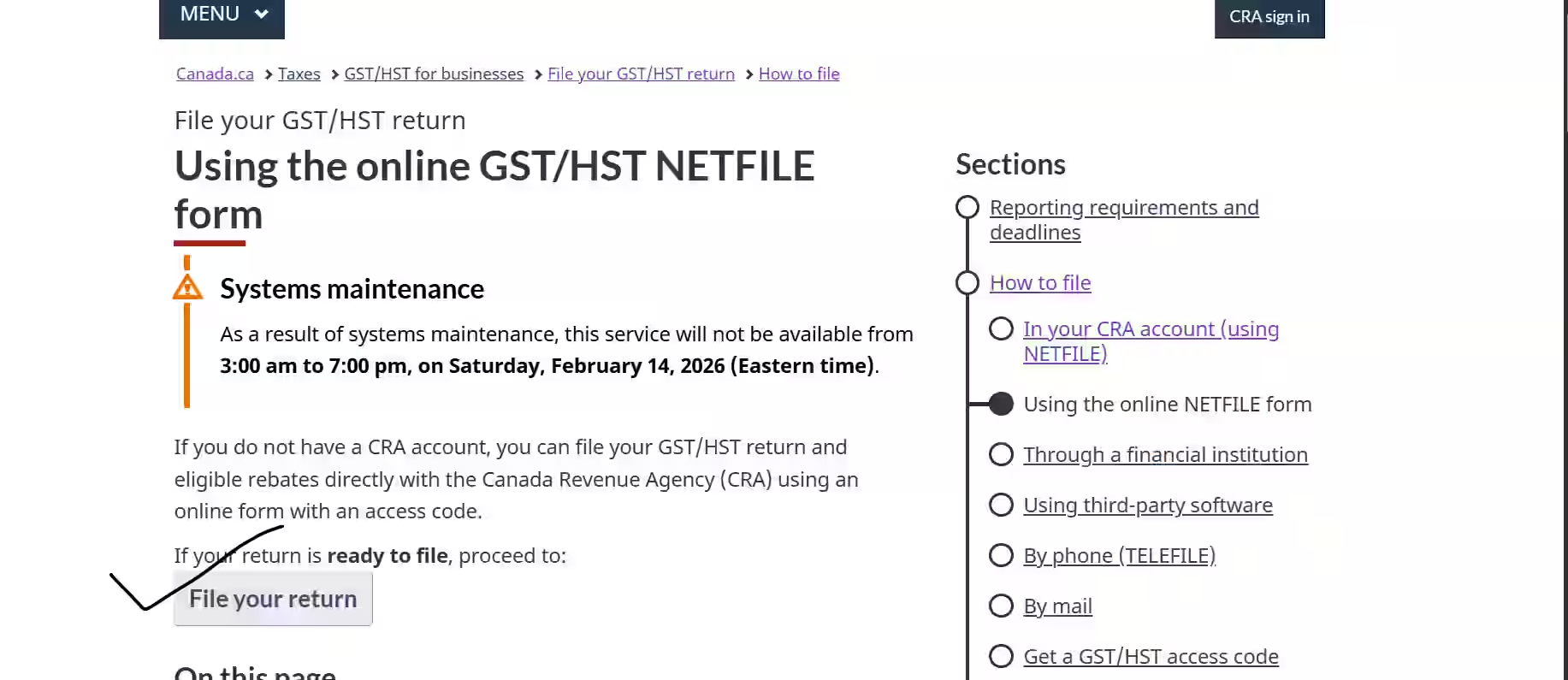

GST/HST NETFILE form

Direct filing form that often requires an access code.

Use our calculator

Convert your totals into the GST/HST boxes before filing on CRA.

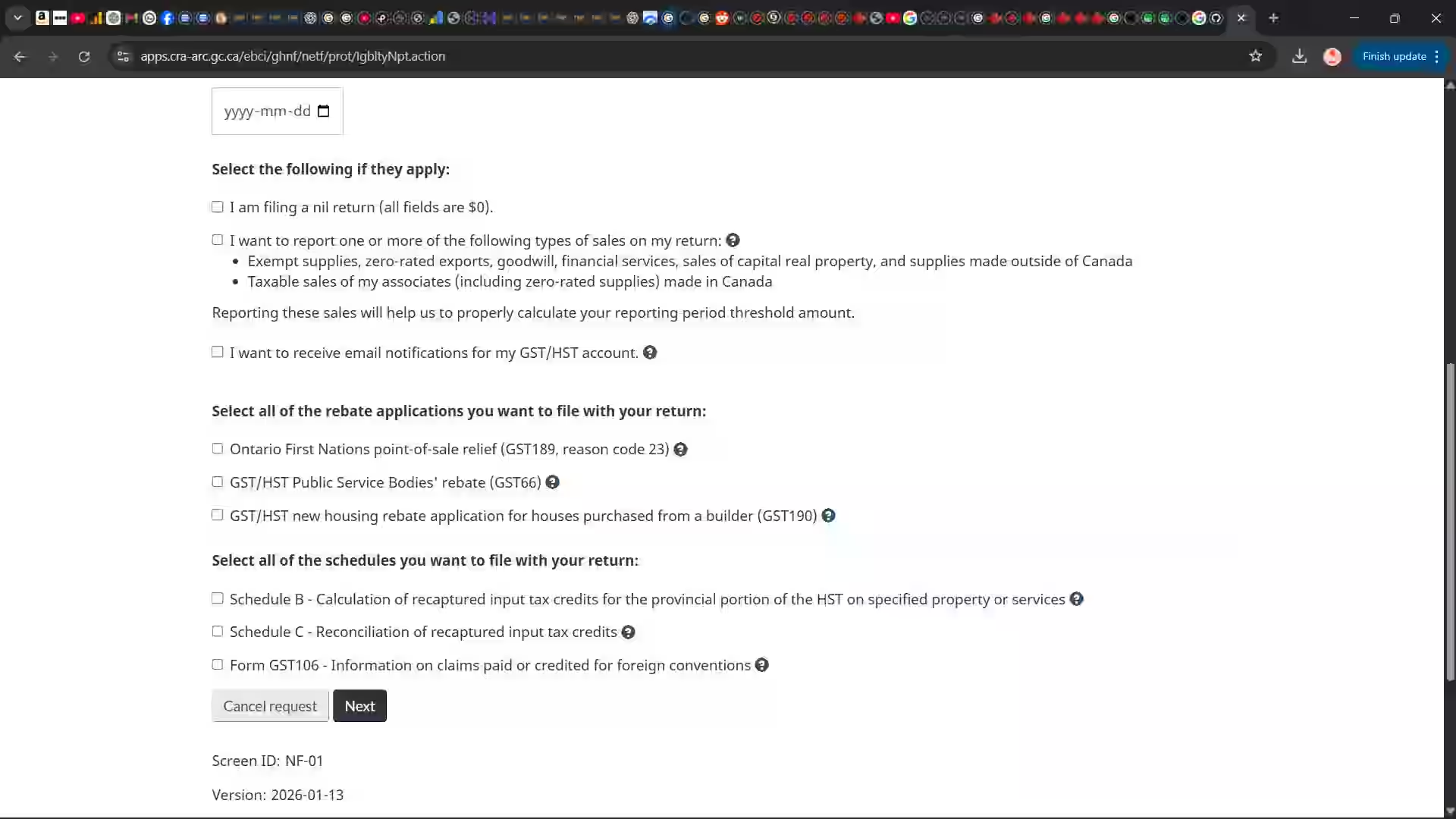

Open GST/QST calculatorFind the NETFILE form

Search the CRA site for the GST/HST NETFILE form and open the official filing page.

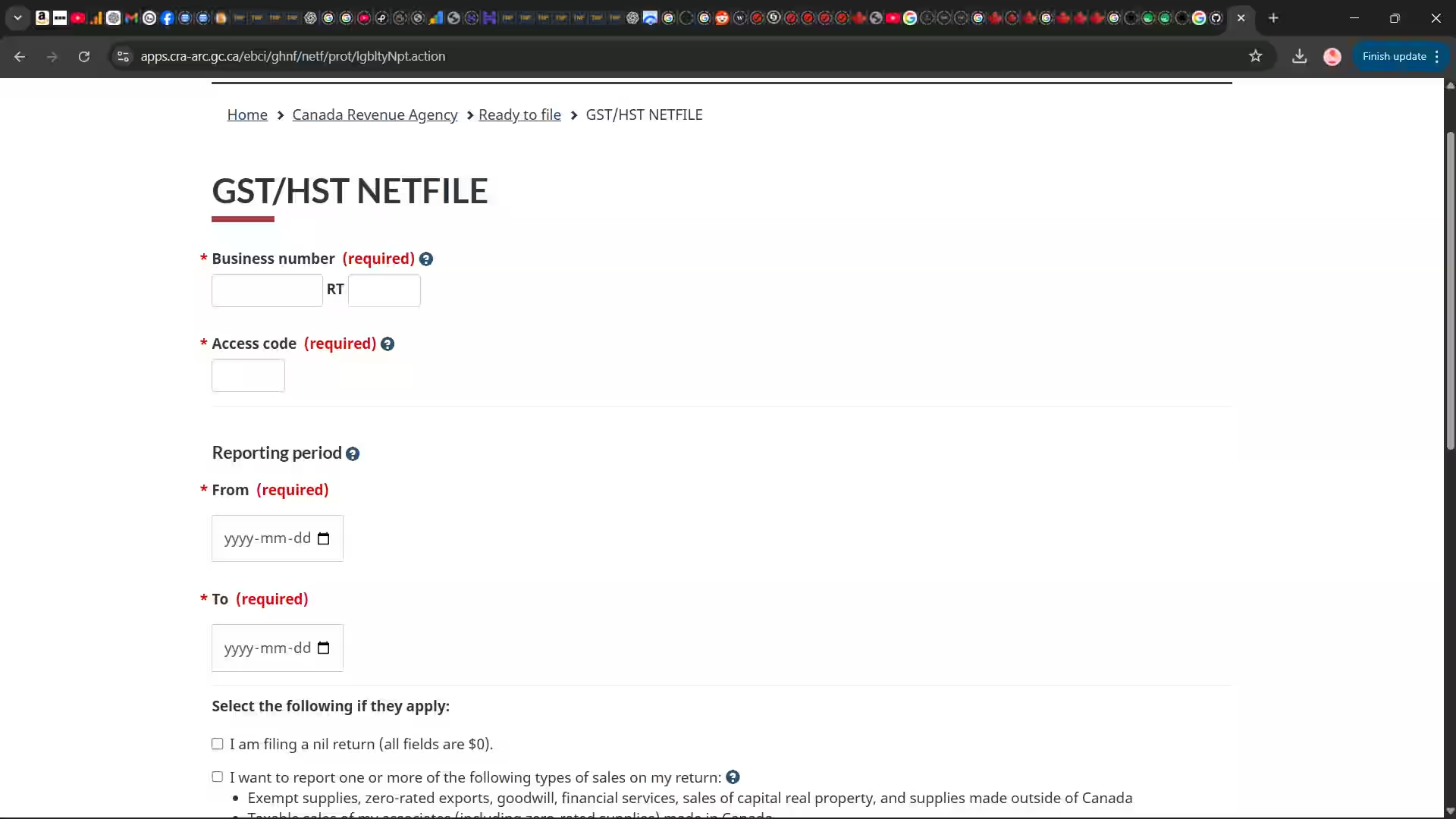

Enter your totals in the form

Enter your business number, access code, reporting period, and GST/HST totals. Review before submitting.

| Calculator box | CRA NETFILE line |

|---|---|

| GST/HST collected | GST/HST collectible |

| ITCs | ITCs |

| Total payable/refund | Total result |

Review and submit

Double-check totals, submit the return, and save the confirmation number for your records.